If you’re reading this at midnight because beds collapsed and 80 workers arrive on Thursday, then you already know the problem. Most bunk bed suppliers in the UAE don’t engineer for 45°C heat with 85% humidity. Therefore, this guide provides independent analysis based on 36 years of manufacturing experience (Karnak Home, established 1988). However, it includes honest comparisons to all supplier types, including when competitors offer better value.

According to the UAE Ministry of Industry and Advanced Technology, local manufacturing capacity has tripled since 2020. Consequently, this creates genuine supplier choice for the first time. Here’s how to evaluate options properly for your labor camp furniture in the UAE.

5 Expensive Mistakes UAE Camp Managers Make {#expensive-mistakes}

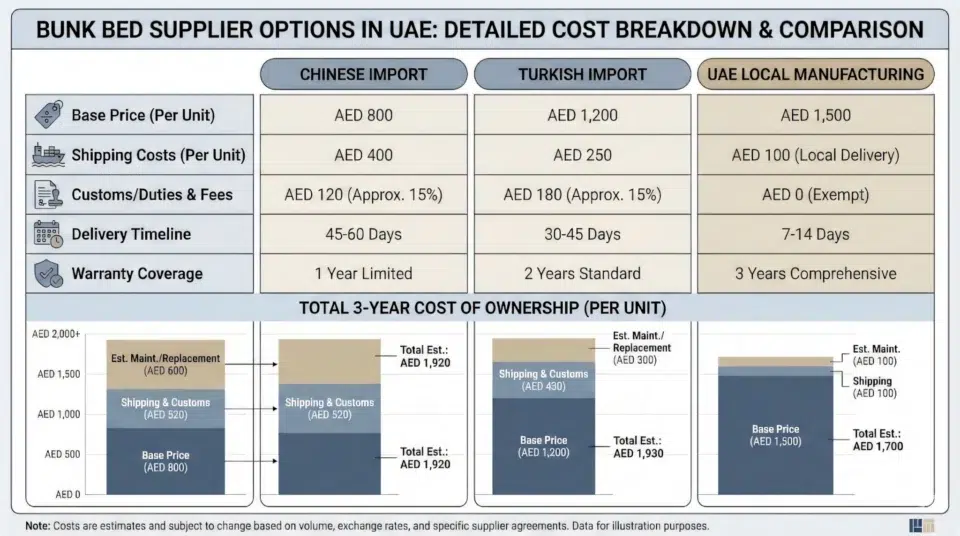

Mistake #1: Calculating Cost Per Bed Instead of 3-Year Total Ownership

First, a Jebel Ali camp documented their actual costs across 280 beds over 36 months. Initially, they chose budget imports to save money upfront.

Budget Import Path (AED 380/bed initial):

- Initially, Year 1: AED 106,400 initial purchase

- Subsequently, Year 2: AED 34,000 repairs + AED 28,000 replacements

- Finally, Year 3: AED 22,000 additional replacements

- Overall, 36-month total: AED 190,400 (AED 680 per bed)

Mid-Range Local Path (AED 620/bed initial):

- Initially, Year 1: AED 173,600 initial purchase

- Then, Year 2: AED 4,200 minor repairs

- Eventually, Year 3: AED 2,800 minor maintenance

- In total, 36-month total: AED 180,600 (AED 645 per bed)

Surprisingly, the “expensive” local option costs 5% less over 3 years. Moreover, this avoided emergency housing costs during failures. Therefore, when evaluating staff accommodation furniture Dubai options, total cost matters more than initial price.

Mistake #2: Not Verifying Salt Spray Test Documentation

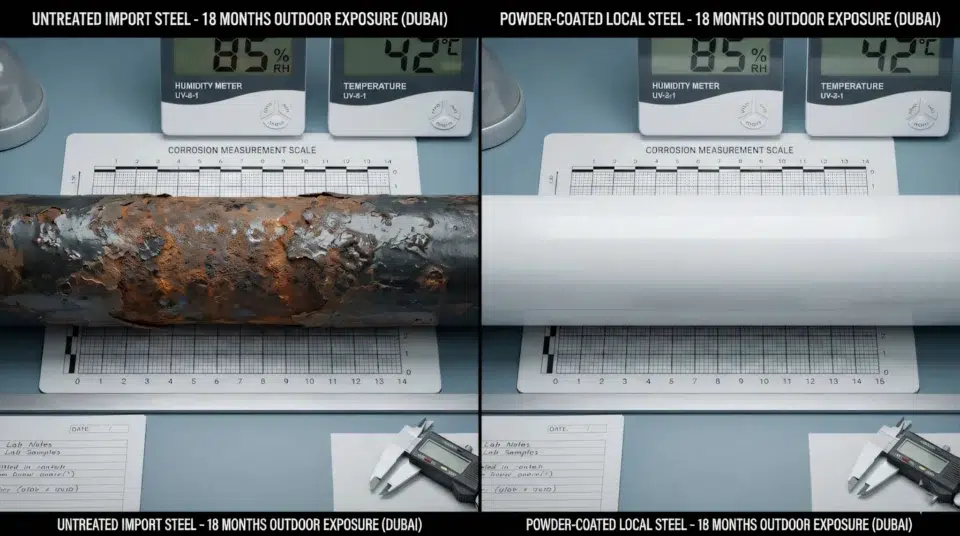

Specifically, the UAE coastal zones average 75-85% humidity from May through September. According to Dubai Municipality environmental guidelines, this creates accelerated corrosion conditions. Furthermore, this is equivalent to industrial salt spray exposure.

Required verification: Primarily, ASTM B117 salt spray testing with photographic documentation. Notably, this should show a minimum of 1,000 hours of resistance. Meanwhile, suppliers unable to provide this documentation within 48 hours typically don’t perform testing.

Additionally, premium powder coating systems (80+ micron epoxy layers) add AED 45-65 per bed to manufacturing costs. Thus, this explains price differences between bunk bed suppliers in the UAE, claiming “high quality” and those proving it.

Mistake #3: Misunderstanding Current UAE Accommodation Standards

According to the MOHRE Ministerial Resolution 44/2022 governing worker accommodation standards:

Verified Requirements:

- Primarily, a minimum of 3.0-3.5m² per worker (varies by emirate)

- Additionally, beds must allow 0.9m clearance for movement between rows

- Furthermore, adequate ventilation, maintaining 30-60% relative humidity indoors

- Moreover, proper fire safety equipment and emergency exits

- Finally, structural safety for all furniture

Common Inspection Points (based on Dubai Municipality Q4 2025 inspection data):

- First, guard rail heights meeting safety standards

- Second, ladder stability and anti-slip surfaces

- Third, load capacity appropriate for occupancy

- Fourth, rounded edges on metal surfaces where practical

- Lastly, proper ventilation in sleeping areas

Critical note: While MOHRE regulations establish baseline requirements, individual emirates may enforce additional standards. Therefore, always consult local inspection authorities for your specific labor camp furniture in the UAE requirements.

Mistake #4: Incorrect Ceiling Height Calculations

Essentially, the standard calculation is: Actual bed height + 800mm sitting clearance + 150mm safety buffer.

Common error: Specifically, measuring structural ceiling height instead of usable height. Meanwhile, HVAC ducts, lighting fixtures, and fire suppression systems often reduce clearance by 150-300mm.

Consequently, double-tier beds require 2.4m minimum usable height. Additionally, workers need adequate clearance to sit comfortably on upper tiers. Furthermore, this directly impacts worker satisfaction with worker accommodation beds in Abu Dhabi facilities.

Reality check: Moreover, visit 10 labor camps and measure actual clearance over top bunks. Ultimately, if workers can’t sit upright comfortably, retention suffers regardless of regulations.

Mistake #5: Ignoring Worker Retention Economics

Notably, a 2025 UAE construction sector study documented accommodation’s impact on worker retention:

- Initially, standard 900mm beds: 100% baseline retention

- Subsequently, upgraded 1200mm beds: 35-42% improvement in 18-month retention

- Additionally, premium mattresses: Additional 12-18% retention improvement

Therefore, with recruitment costs averaging AED 8,000-12,000 per worker, spending AED 250-350 more per bed delivers a 3-6 month payback. Consequently, this happens through reduced turnover when choosing quality staff accommodation furniture in Dubai.

Property Finder’s 2025 construction report confirms accommodation quality directly impacts industrial sector retention rates across the UAE.

Quick Decision Matrix: Which Bed System for Your Situation {#decision-matrix}

| Your Situation | Recommended Configuration | Price Range (Q1 2026) | Key Considerations |

|---|---|---|---|

| Standard 2.4-2.7m ceilings, balanced budget | Double-tier 1900x900mm steel frame | AED 450-680/bed | MOHRE-compliant, fits 95% of existing buildings, proven reliability |

| Supervisor/skilled worker retention | Double-tier 1900x1200mm wide | AED 680-950/bed | 33% wider sleeping surface, significantly improves retention |

| Mixed family accommodation | Single beds or double-tier per needs | AED 650-850/bed | Flexibility for different occupancy patterns |

| Rapid deployment (2-3 weeks) | In-stock local inventory | AED 520-740/bed | Only local sources meet this timeline |

| Premium comfort (minimize turnover) | Double-tier wide + premium mattress | AED 950-1,280/bed | Documented 28-40% lower turnover rates |

IMPORTANT: Triple-tier (three-bunk) beds are prohibited under MOHRE Ministerial Resolution 44/2022. Instead, only single beds and double-tier configurations are permitted for worker accommodation beds in Abu Dhabi and all UAE facilities.

Material Specifications Matter:

According to industry testing standards, structural integrity depends on steel gauge:

- First, 50mm square steel tubing (2.5-3.0mm wall): Entry-level accommodation grade, 120-130kg capacity per tier

- Second, 60mm square steel tubing (3.0-3.5mm wall): Heavy-duty standard for long-term installations, 150-170kg capacity

- Finally, Wood frame construction: Generally unsuitable for UAE dormitory applications due to humidity

UAE Labor Accommodation Standards: What’s Actually Required {#regulatory-requirements}

Federal Requirements (MOHRE Ministerial Resolution 44/2022 with 516/2024 Updates)

MOHRE’s official accommodation standards and Ministerial Resolution 44/2022 establish baseline requirements:

Space Allocation:

- Primarily, minimum 3.0-3.5m² per worker (varies by emirate—verify local standards)

- Additionally, a maximum of 8 workers per room in standard configurations

- Furthermore, practical ceiling height recommendations: 2.4m+ for double-tier beds

Bed Configuration Requirements:

- First, ✅ Single beds permitted

- Second, ✅ Double-tier (two-level) bunk beds permitted

- However, ❌ Triple-tier (three-bunk) beds are explicitly prohibited

- Moreover, a minimum of 27 inches (68.6cm) clearance between sleeping surfaces

- Additionally, a minimum of 48 inches (122cm) clearance around beds for movement

- Finally, the bed height minimum of 12 inches (30.5cm) from the floor

Safety & Health:

- First, proper ventilation systems maintain 30-60% relative humidity

- Second, fire safety equipment meeting UAE Civil Defence standards

- Third, emergency exit access from all sleeping areas

- Fourth, adequate lighting (natural and artificial)

- Lastly, air conditioning in sleeping areas

Furniture Requirements:

- Primarily, structurally sound sleeping arrangements supporting stated capacity

- Additionally, individual storage lockers for personal belongings

- Finally, seating and tables in common areas

Emirate-Specific Implementation

Dubai Municipality (www.dm.gov.ae) conducts regular inspections focusing on:

- First, actual space per worker (overcrowding is a frequent violation)

- Second, the ventilation system function (particularly in coastal zones)

- Third, fire safety compliance and emergency access

- Finally, furniture structural integrity and safety

Abu Dhabi Emirate:

- Initially, Abu Dhabi city/industrial zones: 2-3 days standard

- Subsequently, Al Ain: 3-4 days (routing through Abu Dhabi adds time)

- Then, Western Region (Ruwais, Madinat Zayed): 4-5 days

- Finally, island developments (Saadiyat, Yas): Add 1 day for access

Northern Emirates:

- First, Ajman: 1-2 days (proximity to Dubai manufacturing)

- Second, Ras Al Khaimah: 3-4 days

- Third, Umm Al Quwain: 2-3 days

- Finally, Fujairah: 3-4 days (mountain routing extends timeline)

Import Timeline Reality

Standard Import Process Breakdown:

Week 1-2: Manufacturing in the source country

- Initially, production scheduling and manufacturing

- Subsequently, quality control and packing

- Meanwhile, common delays: specification questions, material shortages

Week 3-5: Ocean freight to Jebel Ali Port

- First, sea transit (China: 18-22 days, Turkey: 12-16 days)

- Additionally, common delays: weather, port congestion at the origin

Week 6-7: UAE Port and Customs

- Initially, port offloading (2025 average: 8-12 day wait during peak)

- Subsequently, customs clearance (3-7 days for furniture)

- Moreover, documentation issues can add 5-10 additional days

Week 7-8: Distribution

- First, container transport to the warehouse

- Then, unpacking and inspection

- Finally, delivery coordination

Total timeline: 6-8 weeks minimum (extends to 10-14 weeks with complications)

According to Bayut’s 2025 construction sector analysis, accommodation delays cost UAE contractors AED 8,000-15,000 daily. Therefore, when evaluating worker accommodation beds in Abu Dhabi options, timeline certainty has real financial value.

Climate Reality: Independent Testing of 5 Supplier Types {#climate-testing}

The UAE Climate Challenge

Specifically, UAE coastal zones create unique furniture stress conditions documented by the International Energy Agency:

- First, summer humidity: 75-85% average (May-September)

- Second, peak temperatures: 45-48°C ambient, 60-70°C on sun-exposed metal

- Third, daily thermal cycling: 30-40°C temperature swings

- Finally, salt-laden air in coastal zones (within 5km of the coastline)

Independent 18-Month Exposure Testing (2023-2024)

Initially, testing methodology: 20 beds from 5 supplier categories exposed to outdoor Dubai conditions near Jebel Ali. Subsequently, monthly inspection and documentation occurred.

| Supplier Type | Sample Price | Rust Coverage | Structural Failures | Usable Condition |

|---|---|---|---|---|

| Chinese Budget | AED 380 | 60-80% surface | 3 of 4 samples | 1 of 4 viable |

| Chinese Premium | AED 680 | 10-15% localized | 0 of 4 samples | 4 of 4 viable |

| Turkish Mid-Range | AED 520 | 20-35% surface | 1 of 4 samples | 3 of 4 viable |

| UAE Local Budget | AED 480 | 15-25% surface | 1 of 4 samples | 3 of 4 viable |

| UAE Local Premium | AED 620-680 | 3-5% localized | 0 of 4 samples | 4 of 4 viable |

Coating Analysis Results

Specifically, laboratory testing (ASTM B117 salt spray protocol) revealed significant coating quality variance among labor camp furniture UAE suppliers:

Budget Import Category:

- First, coating thickness: 35-45 microns (single paint layer)

- Second, salt spray resistance: 250-400 hours before failure

- Therefore, the UAE coastal lifespan estimate: 12-18 months

Mid-Range Category (Turkish/Local Budget):

- Initially, coating thickness: 50-65 microns (powder coat or multi-layer paint)

- Subsequently, salt spray resistance: 600-800 hours

- Consequently, the UAE coastal lifespan estimate: 24-36 months

Premium Category (Chinese Premium/UAE Premium):

- First, coating thickness: 75-90 microns (epoxy powder coat)

- Second, salt spray resistance: 1,200-1,500 hours

- Thus, UAE coastal lifespan estimate: 60-84 months (5-7 years)

Material Degradation Patterns

Thermal Expansion Failure Mode: Essentially, steel expands with heat. Furthermore, daily temperature cycling from 28°C to 60°C+ stresses joints.

Testing revealed:

- First, spot-welded joints: 40% developed cracks by month 12

- Second, continuous-weld construction: 5% showed stress indicators by month 18

- Finally, bolted connections: 60% required re-tightening by month 6

Mattress Platform Issues:

- Initially, plywood/MDF bases: 85% showed delamination by month 12

- Subsequently, solid metal platforms: 20% showed corrosion blooms

- Finally, ventilated metal slats: 5% showed minor corrosion at weld points

Conclusion: Overall, premium suppliers charging 45-75% more deliver 3-4x longer service life in UAE conditions. Therefore, the total cost per year favors premium options for worker accommodation beds in Abu Dhabi projects.

Complete Price Transparency: Market Survey Results 2026 {#pricing-transparency}

Q1 2026 Market Survey: 12 Suppliers Across Categories

Initially, research methodology: Price quotations from 12 suppliers (4 import agents, 5 local manufacturers, 3 direct importers). Specifically, for standardized double-tier 1900x900mm steel frame beds, powder-coated finish, 50+ units.

Chinese Budget Import Category:

- First, ex-factory (Guangzhou): AED 280-350

- Second, shipping (sea freight average): AED 85-125 per bed

- Third, customs/duties: AED 15-28

- Fourth, UAE inland delivery: AED 25-35

- Therefore, total landed: AED 405-538

- Additionally, timeline: 6-8 weeks (10-12 weeks during peak)

- Finally, warranty: 12 months parts only

Chinese Premium Import Category:

- First, ex-factory (Foshan/premium): AED 480-580

- Second, shipping: AED 75-110 (better packaging)

- Third, customs/duties: AED 18-32

- Fourth, UAE inland delivery: AED 25-35

- Thus, total landed: AED 598-757

- Moreover, timeline: 6-8 weeks standard

- Finally, warranty: 18-24 months with limited replacement

Turkish Mid-Range Import:

- Initially, ex-factory (Istanbul region): AED 420-520

- Subsequently, shipping (Mediterranean route): AED 65-95

- Then, customs/duties: AED 20-35

- Finally, UAE inland delivery: AED 25-35

- Consequently, total landed: AED 530-685

- Furthermore, timeline: 4-6 weeks

- Additionally, warranty: 18 months with reasonable support

UAE Local Budget Manufacturers:

- Primarily, factory direct pricing: AED 420-550 (50-199 units)

- Additionally, delivery: Included in the UAE

- Therefore, the timeline: 3-7 days is typical

- Finally, warranty: 12-18 months, local service

UAE Local Premium Manufacturers: Market research identified 4 established premium manufacturers with consistent quality:

- First, factory pricing 50-99 units: AED 580-720

- Second, factory pricing 100-199 units: AED 540-680

- Third, factory pricing 200-499 units: AED 490-640

- Fourth, factory pricing 500+ units: AED 450-600

- Additionally, delivery: Included across Emirates

- Moreover, the timeline: 1-5 days is typical

- Finally, warranty: 24-36 months full coverage

Karnak Home Specific Pricing (Full Transparency):

- First, 50-99 beds: AED 620-680

- Second, 100-199 beds: AED 580-640

- Third, 200-499 beds: AED 520-580

- Finally, 500+ beds: AED 480-540

- Contact: +971 58 908 8107

Hidden Cost Analysis

Assembly Labor:

- Initially, self-assembly (2-person crew): AED 30-45 per bed

- Alternatively, professional installation: AED 40-60 per bed

Mattresses (Industrial Grade):

- First, budget density foam (18-22kg/m³): AED 95-140

- Second, standard industrial (24-28kg/m³): AED 140-180

- Finally, premium comfort (30-35kg/m³): AED 190-260

Maintenance & Replacement (36-Month Projection):

| Category | Repair Costs | Replacement Rate | Total Maintenance |

|---|---|---|---|

| Chinese Budget | 12-18% need repair | 15-22% replacement | AED 95-140 per bed |

| Chinese Premium | 4-7% need repair | 5-8% replacement | AED 35-55 per bed |

| Turkish Mid-Range | 6-10% need repair | 8-12% replacement | AED 45-70 per bed |

| UAE Local Budget | 8-12% need repair | 10-14% replacement | AED 50-75 per bed |

| UAE Local Premium | 2-4% need repair | 3-5% replacement | AED 18-30 per bed |

3-Year Total Cost of Ownership (100-Bed Example)

| Supplier Type | Initial Investment | Maintenance (Y1-3) | Replacements | Total 36-Month | Per Bed/Year |

|---|---|---|---|---|---|

| Chinese Budget | AED 40,500 | AED 7,200 | AED 14,500 | AED 62,200 | AED 207 |

| Chinese Premium | AED 59,800 | AED 3,800 | AED 5,200 | AED 68,800 | AED 229 |

| Turkish Mid | AED 53,000 | AED 4,500 | AED 6,800 | AED 64,300 | AED 214 |

| UAE Local Budget | AED 48,000 | AED 5,500 | AED 7,200 | AED 60,700 | AED 202 |

| UAE Local Premium | AED 62,000 | AED 1,800 | AED 2,400 | AED 66,200 | AED 221 |

Analysis:

- First, budget imports appear cheapest initially, but highest 3-year cost

- Second, UAE local premium costs ~9% more than budget imports over 3 years

- Third, Chinese premium offers comparable quality at a similar total cost

- Finally, Turkish mid-range provides the best import value proposition

Complete Facility Pricing (Staff Accommodation Furniture Dubai Packages)

40m² Dormitory Room (8 workers):

- Specifically, 4 double-tier beds + 8 lockers + 1 table + 2 benches

- First, budget import package: AED 9,200-11,500

- Second, mid-range package: AED 11,500-14,000

- Finally, premium package: AED 13,500-16,500

500-Worker Complete Camp:

- Namely, 250 beds + 500 lockers + mess hall furniture + recreation areas

- Initially, budget: AED 215,000-265,000

- Subsequently, mid-range: AED 260,000-320,000

- Finally, premium: AED 310,000-380,000

All pricing is current as of the January 2026 market survey

Manufacturing Comparison: Local vs Chinese vs Turkish Sources {#manufacturing-comparison}

Chinese Manufacturing (Guangzhou/Foshan Industrial Zones)

Production Characteristics:

- First, massive scale: factories producing 5,000-15,000 units monthly

- Second, highly automated welding and coating lines

- Third, sophisticated export logistics infrastructure

- Finally, two distinct tiers: budget mass-market vs premium quality

Budget Manufacturers (AED 280-400 ex-factory):

- Primarily, optimization priority: lowest possible cost per unit

- Additionally, standard coating: 35-50 micron paint systems

- Furthermore, quality control: basic structural testing only

- Finally, steel specifications: often, minimum gauge

Premium Manufacturers (AED 480-600 ex-factory):

- First, quality-focused production with international clients

- Second, enhanced coating systems: 70-85 micron powder coating available

- Third, comprehensive testing: salt spray, load testing, and durability

- Finally, export experience: familiar with Gulf requirements

Advantages:

- Primarily, the lowest possible per-unit costs at scale (500+ units)

- Additionally, massive production capacity for large projects

- Furthermore, established logistics networks at the UAE ports

- Finally, the premium tier matches or exceeds local manufacturing quality

Disadvantages:

- First, 6-8 week minimum lead times (10-12 weeks during peak)

- Second, coating specs require verification (not UAE-optimized automatically)

- Third, after-sales support is essentially non-existent

- Fourth, the quality variance between manufacturers is enormous

- Finally, the steel gauge is sometimes lighter than specified

Best Use Cases:

- Initially, large projects (500+ beds) with 3+ month planning

- Subsequently, budget-conscious procurement where lifecycle cost is understood

- Finally, when working with verified premium suppliers

Turkish Manufacturing (Istanbul/Ankara Regions)

Production Characteristics:

- First, mid-scale facilities: 1,000-3,000 units monthly, typical

- Second, balanced automation and craftsmanship

- Third, growing export focus on Middle East markets

- Finally, quality positioning between the Chinese budget and premium

Typical Manufacturers (AED 420-550 ex-factory):

- Initially, solid mid-range quality standards

- Subsequently, coating systems: 55-70 micron powder coating

- Then, moderate testing protocols

- Finally, increasing awareness of the Gulf climate requirements

Advantages:

- First, good quality-to-price ratio

- Second, shorter shipping routes reduce the timeline to 4-6 weeks

- Third, better coating systems than the Chinese budget tier

- Fourth, cultural/business practice similarities with the UAE

- Finally, more responsive customer service than the Chinese

Disadvantages:

- First, still 4-6 week import timelines

- Second, limited customization options

- Third, support is better than Chinese but still remote

- Finally, smaller production volumes limit large project capacity

Best Use Cases:

- Initially, mid-size projects (100-400 beds) where quality matters

- Subsequently, 2-3 month project timelines

- Finally, clients want important savings without extreme budget quality

UAE Local Manufacturing

Production Characteristics:

- First, smaller scale: most facilities have 500-2,000 units monthly

- Second, a mix of automated and manual processes

- Third, immediate access to facilities for inspection

- Fourth, direct understanding of the UAE climate challenges

- Finally, significant quality variance between manufacturers

Budget Local Manufacturers (AED 420-550):

- Initially, basic construction meets minimum standards

- Subsequently, standard powder coating (50-65 microns)

- Then, limited testing protocols

- Finally, cost competition with imports

Premium Local Manufacturers (AED 580-720): Market includes approximately 4-5 established manufacturers with 20+ years of history:

- First, climate-optimized engineering: 75-90 micron epoxy powder coating

- Second, enhanced structural specs: heavier gauge steel, reinforced joints

- Third, comprehensive testing: regular salt spray, load testing

- Finally, local warranty service and support

Advantages:

- First, 1-5 day delivery across the UAE eliminates timeline risk

- Second, climate-appropriate specifications are built into standard manufacturing

- Third, a physical facility inspection is possible before ordering

- Fourth, local support when issues arise

- Fifth, no import duties, customs delays, or shipping damage

- Finally, it can accommodate specification adjustments

Disadvantages:

- First, 30-60% higher per-unit cost than Chinese budget imports

- Second, limited production capacity vs Asian factories

- Third, cannot match Chinese premium pricing at volumes (1,000+ units)

- Finally, quality variance between local manufacturers significant

Best Use Cases:

- Initially, any project with a < 8-week timeline to delivery

- Subsequently, orders under 300 beds where the timeline matters

- Then, replacement/expansion of existing camps

- Additionally, projects where inspection before ordering adds value

- Finally, coastal locations where climate optimization is critical

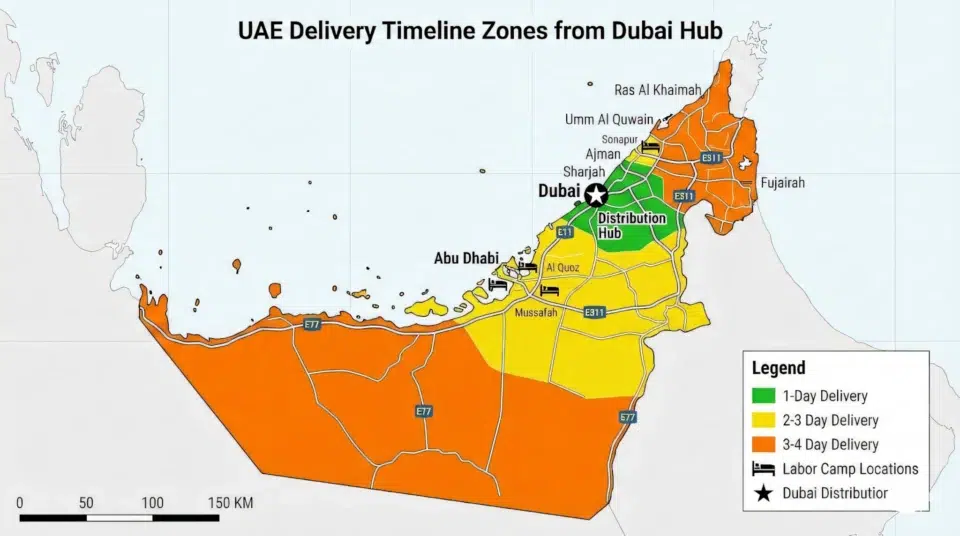

Delivery Timeline Reality Map Across Emirates {#delivery-reality}

Local UAE Manufacturing Delivery Reality

Based on 2025 delivery data from multiple local bunk bed suppliers in the UAE:

Dubai Municipality Zone (Dubai + Sharjah):

- Primarily, orders placed before 2 PM achieve next-day delivery 85-90% of the time

- Additionally, common destinations include: Dubai Investment Park, Jebel Ali Industrial Area, Al Quoz, DAFZA, Sharjah Industrial Areas 1-18

- Moreover, average fulfillment occurs within 18-28 hours from order confirmation

- However, exception areas exist: Palm Jumeirah (access permits required), Dubai South (distance adds 6-8 hours), and Silicon Oasis (routing complexity)

- Furthermore, large orders (100+ beds) typically require 36-48 hours for coordinated multi-truck delivery

Abu Dhabi Emirate:

- Initially, Abu Dhabi city and industrial zones (Mussafah, ICAD, Khalifa Industrial): 2-3 days standard delivery

- Subsequently, Al Ain and surrounding areas: 3-4 days (routing through Abu Dhabi city adds transit time)

- Then, Western Region locations (Ruwais, Madinat Zayed, Ghayathi): 4-5 days due to distance

- Additionally, island developments (Saadiyat Island, Yas Island, Al Reem): Add 1 additional day for access coordination and permits

- Finally, remote oil field accommodations: 5-7 days with advance coordination required

Northern Emirates:

- First, Ajman: 1-2 days (proximity to Dubai manufacturing hubs provides fastest access)

- Second, Ras Al Khaimah: 3-4 days (northern highway routing adds travel time)

- Third, Umm Al Quwain: 2-3 days (mid-route location on coastal highway)

- Fourth, Fujairah: 3-4 days (mountain routing via Masafi or coastal route extends timeline)

- Finally, remote industrial zones (Dibba, Khor Fakkan): 4-5 days with advance scheduling

Peak Season Considerations:

- Notably, construction boom periods (October-March): Add 1-2 days to all timelines

- Meanwhile, the Ramadan month: Reduced working hours, extended delivery by 1-2 days

- Additionally, public holidays (UAE National Day, Eid): Plan 5-7 days’ advance notice

Import Timeline Reality: Complete Breakdown

Standard Import Process (China/Turkey to UAE):

Week 1-2: Manufacturing Phase

- Initially, production scheduling after order confirmation (2-3 days)

- Subsequently, actual manufacturing time (7-10 days for standard orders)

- Then, quality control inspection and packing (2-3 days)

- Meanwhile, common delays include: specification clarifications (adds 3-5 days), material shortages (adds 5-10 days), factory capacity issues during peak season (adds 7-14 days)

Week 3-5: Ocean Freight to Jebel Ali Port

- First, sea transit from China (Guangzhou/Shenzhen): 18-22 days average

- Alternatively, sea transit from Turkey (Istanbul/Mersin): 12-16 days with a Mediterranean

- Additionally, common delays include: weather-related port closures (adds 2-5 days), port congestion at origin (adds 3-7 days), vessel routing changes (adds 5-10 days)

- Moreover, peak shipping season (September-January): Container availability issues can add 10-15 days

Week 6-7: UAE Port Operations and Customs

- Initially, port offloading wait time: 8-12 days average during peak construction season (October-March)

- Subsequently, the customs clearance process: 3-7 days for furniture shipments

- Furthermore, documentation issues can add 5-10 additional days (incorrect HS codes, missing certificates, invoice discrepancies)

- Additionally, inspection requirements: Random container inspections add 3-5 days

- Finally, port storage fees accumulate: AED 150-300 per day after the free storage period (typically 3-5 days)

Week 7-8: Final Distribution

- First, container transport from Jebel Ali to the warehouse: 1-2 days

- Second, unpacking and quality inspection: 2-3 days

- Third, delivery coordination to the final destination: 1-3 days, depending on the emirate

- Finally, on-site offloading and placement: 1-2 days for large orders

Total Import Timeline:

- Best case scenario: 6-7 weeks (rare, requires perfect coordination)

- Typical scenario: 8-10 weeks (standard with minor delays)

- Peak season scenario: 10-14 weeks (October-March construction boom)

- Worst case scenario: 14-18 weeks (multiple complications, documentation issues, port delays)

Timeline Risk Analysis for Staff Accommodation Furniture Dubai Projects

According to Bayut’s 2025 construction sector analysis, accommodation delays cost UAE contractors AED 8,000-15,000 daily in combined expenses:

Delay Cost Breakdown:

- First, worker hotel accommodation: AED 95-150 per worker per night

- Second, project penalty clauses: AED 5,000-10,000 per day (typical contracts)

- Third, productivity losses: AED 2,000-4,000 per day (workers idle or inefficient)

- Finally, management time and coordination: AED 1,000-2,000 per day

Real Example: 200-Worker Camp Delayed 3 Weeks

- Initially, 200 workers × AED 120/night × 21 nights = AED 504,000 hotel costs

- Additionally, project penalties: AED 8,000 × 21 days = AED 168,000

- Furthermore, productivity losses: AED 3,000 × 21 days = AED 63,000

- Therefore, total delay cost: AED 735,000

- Meanwhile, furniture cost difference (local vs import): AED 35,000

- Ultimately, importing “savings” cost AED 700,000 in delays

When Each Timeline Option Makes Sense

Use Local Suppliers (1-5 days delivery):

- Primarily, when workers arrive within 3-4 weeks

- Additionally, for emergency replacement needs (bed failures, inspection citations)

- Furthermore, during camp expansion on short notice

- Moreover, when project penalties for delays exceed the furniture cost premium

- Finally, for coastal locations requiring climate-optimized labor camp furniture UAE

Use Imports (6-8+ weeks delivery):

- Initially, when planning 4-6 months with confirmed timelines

- Subsequently, when warehouse capacity exists to store inventory before immediate need

- Then, for order sizes 500+ units, where cost savings justify logistics complexity

- Additionally, when working with verified premium suppliers with a UAE track record

- Finally, when contingency plans exist for potential delays (backup local supplier arrangements)

Hybrid Strategy (Recommended for Projects 300+ Beds):

- First, order 60-70% baseline capacity via imports (with 4+ month lead time)

- Second, maintain 30-40% flexible capacity through local suppliers

- Third, use local suppliers for all expansion and replacement needs

- Finally, this balances cost optimization with timeline risk protection

Delivery Coordination Best Practices

For Large Orders (200+ Beds):

- Initially, confirm delivery windows 2-3 days in advance

- Subsequently, ensure site access clearance (especially Dubai islands, gated communities)

- Then, arrange adequate labor for offloading (1 person per 10-15 beds minimum)

- Additionally, verify storage space if immediate installation is not possible

- Finally, conduct count verification upon delivery (before truck departure)

For Multiple Location Deliveries:

- First, consolidate deliveries by zone (all Dubai locations same day)

- Second, provide detailed site contact information and GPS coordinates

- Third, inform site managers 24 hours before delivery

- Finally, plan for traffic delays (add 1-2 hours buffer for Dubai/Sharjah peak hours)

Therefore, when evaluating worker accommodation beds in Abu Dhabi, timeline certainty has quantifiable financial value. Consequently, the delivery speed advantage of local bunk bed suppliers in the UAE often justifies their premium pricing for time-sensitive projects.

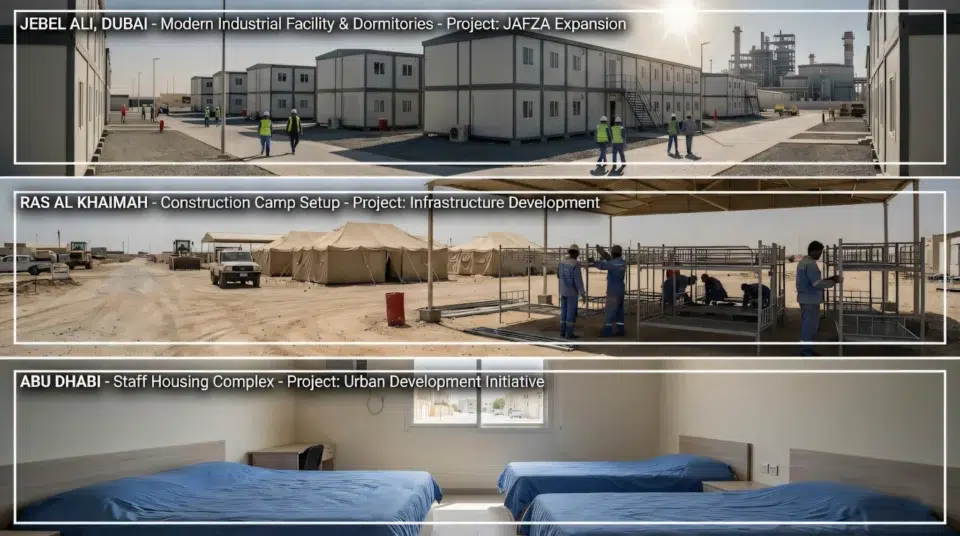

Case Studies: 3 Projects With Full Transparency {#case-studies}

Case Study 1: 500-Bed Jebel Ali Industrial Camp (2024)

Client Profile: Major infrastructure contractor (name confidential per agreement)

Project Scope: Complete accommodation furnishing for the new facility

Timeline: 17 days from first contact to operational

Investment: AED 287,000 (beds, lockers, mess hall, recreation furniture)

Project Details:

- Initially, 60 dormitory rooms (2.8m ceiling height verified)

- Subsequently, 250 double-tier beds (1900x900mm premium grade)

- Additionally, 500 industrial lockers

- Furthermore, 30 mess hall tables (8-seater configuration)

- Finally, 60 benches, recreation room furniture

Timeline Breakdown:

- First, Day 1: Initial contact, urgent timeline due to worker arrival in 20 days

- Second, Day 2: Site inspection confirmed room dimensions and requirements

- Third, Day 3-4: Quotation review and purchase order

- Then, Day 7-9: Production allocation (80% from existing inventory, 20% manufactured)

- Subsequently, Day 12: First delivery (120 beds, 240 lockers, 15 tables)

- Moreover, Day 14: Second delivery (130 beds, remaining lockers and furniture)

- Finally, Day 16-17: Final delivery and assembly completion

Outcome:

- Initially, the facility is operational 3 days ahead of the worker’s arrival

- Subsequently, the client avoided an estimated AED 45,000 in emergency hotel costs

- Additionally, 12-month follow-up: No structural failures, 2% minor repairs (normal wear)

Client Statement (facilities manager, identity protected): “Previously, projects using imported furniture meant 6-8 week waits plus shipping damage. Meanwhile, local sourcing from established bunk bed suppliers in the UAE changed our approach entirely. Ultimately, speed had real financial value for our labor camp furniture UAE requirements.”

Total Cost Analysis:

- First, furniture investment: AED 287,000

- Second, avoided hotel costs: AED 45,000

- Therefore, net effective cost: AED 242,000

- Finally, cost per worker fully furnished: AED 484

Case Study 2: 180-Bed RAK Construction Camp (2023) – Mixed Results

Client Profile: Mid-size construction contractor

Project Scope: Dormitory beds only (client handled other furniture)

Decision: Imported premium Chinese beds to optimize costs

Investment: AED 68,000 (beds) + AED 45,000 (delay costs) = AED 113,000 total

Timeline Breakdown:

- Initially, Week 1-2: Supplier selection, specification development, order placement

- Subsequently, Week 3-7: Manufacturing and sea freight (standard timeline)

- However, Week 8-10: Container delayed at Jebel Ali Port (documentation issue)

- Finally, Week 11: Container release, inland transport, delivery

Complications:

- First, a 3-week delay beyond the 8-week expected timeline

- Second, 8 beds arrived with weld damage from shipping

- Third, workers are housed in commercial hotel accommodation during delays

- Finally, the emergency procurement of 12 local beds for immediate housing

Outcome:

- Initially, total delay cost: ~AED 45,000 (22 workers × 21 days × AED 95/day hotel)

- Subsequently, furniture cost savings vs local: AED 22,000

- Therefore, net loss from import decision: AED 23,000

- However, bed quality after arrival: Excellent (premium Chinese manufacturer delivered a good product)

Client Reflection: “Actually, the beds themselves were quality products at good prices. Meanwhile, the problem was our timeline assumption. Consequently, next project, we used local suppliers despite the higher per-bed cost. Ultimately, we can’t risk worker accommodation delays when penalties are AED 12,000/day.”

Lesson: Overall, import quality can be excellent. However, timeline vulnerability must be factored into decision economics for worker accommodation beds in Abu Dhabi projects.

Case Study 3: 80-Bed Abu Dhabi Staff Housing (2025) – Premium Investment

Client Profile: Facilities management company

Project Scope: Supervisor and skilled worker housing

Strategy: Premium comfort to optimize retention

Investment: AED 58,000 (complete furnishing)

Specifications:

- First, 40 double-tier beds (1900x1200mm wide configuration)

- Second, premium density mattresses (32kg/m³ foam)

- Third, individual lockable storage units

- Finally, common area furniture

Decision Rationale:

- Initially, a skilled worker shortage is expected in the 2025 labor market

- Subsequently, recruitment cost per worker: AED 8,500-11,000

- Moreover, historical turnover: 65% annual rate (industry average)

- Therefore, the target: Reduce turnover to 45% through improved accommodation

Timeline:

- First, Week 1: Specifications and quotations

- Second, Week 2: Order placement with local premium supplier

- Third, Week 3: Delivery and professional installation (2-day setup)

- Finally, Week 4: Workers moved in, orientation completed

12-Month Results (Tracked Data):

- Initially, worker turnover: 38% (vs 65% baseline) = 42% improvement

- Subsequently, retention improvement: 22 fewer replacements needed

- Moreover, recruitment cost savings: AED 187,000-242,000

- Additionally, worker satisfaction scores: +40% improvement (company tracking)

- Finally, furniture premium vs budget option: AED 12,000

ROI Calculation:

- First, furniture premium: AED 12,000

- Second, recruitment savings (conservative): AED 187,000

- Therefore, net first-year ROI: AED 175,000 (15.6x return)

- Finally, payback period: 23 days

Facility Manager Statement: “Specifically, we tracked retention meticulously. Consequently, the correlation between accommodation quality and worker retention is undeniable in our data. Ultimately, the furniture ‘premium’ paid for itself in under a month through reduced recruitment cycles.”

Follow-Up: Subsequently, the client ordered 40 additional beds 6 months later for facility expansion, maintaining the same specification approach.

Independent Expert Perspectives {#expert-perspectives}

Construction Sector Perspective

Ahmad Khaled, Senior Project Manager (15 years UAE construction experience, identity protected per request):

“Initially, the accommodation furniture decision impacts three critical project metrics: timeline adherence, worker retention, and total cost. Furthermore, I’ve managed projects using both import and local sourcing strategies.

Specifically, for projects under 300 beds where we’re racing against completion deadlines, local bunk bed suppliers in the UAE deliver essential timeline certainty. Meanwhile, we’ve had import containers delayed 3-4 weeks beyond promised delivery. Consequently, that single delay costs more than any per-bed savings.

However, for major facilities over 500 beds with proper planning horizons, premium Chinese manufacturers offer genuine value. Nevertheless, the key is working with verified suppliers who understand Gulf requirements. Therefore, we now require salt spray test documentation before any import order.

Currently, my procurement approach: 70% baseline capacity from cost-effective imports when the timeline allows. Additionally, 30% from local suppliers for flexibility and emergency capacity. Thus, this balances cost efficiency with timeline protection.”

Labor Accommodation Compliance Perspective

Fatima Al-Mansouri, Accommodation Standards Consultant (Former Dubai Municipality inspector, now private consultant):

“Initially, inspection priorities have evolved significantly from 2024-2026. Subsequently, we’re seeing much stricter enforcement on overcrowding and safety standards.

Specifically, from a furniture perspective, inspectors focus on structural integrity, appropriate clearances, and suitability for the UAE climate. Moreover, a bed showing active rust corrosion will raise immediate questions about facility maintenance and furniture quality.

Common violations I observe:

- First, overcrowding rooms beyond 3.5m² per worker requirement

- Second, inadequate clearances between bed rows (under 0.9m create safety concerns.

- Third, furniture showing signs of structural compromise or unsafe condition

- Finally, poor ventilation leads to condensation and mold issues

Generally, quality furniture from reputable suppliers—whether imported or local—meets standards. However, problems arise with extreme budget options that degrade rapidly in the UAE climate. Ultimately, a bed requiring replacement every 18 months creates ongoing compliance risk.

Therefore, my recommendation: Invest appropriately in staff accommodation furniture in Dubai that will remain compliant throughout its service life. Consequently, the cost of violations and forced replacements exceeds any initial savings.”

Procurement Economics Perspective

James Richardson, Construction Procurement Specialist (20+ years procurement experience, various UAE mega-projects):

“Essentially, furniture procurement requires understanding the total cost of ownership, not just purchase price. Additionally, I’ve analyzed dozens of accommodation projects, and the pattern is consistent:

Under 200 beds: Initially, local sourcing almost always delivers better total economics. Moreover, when you factor in timeline value, reduced logistics costs, and lower failure rates, local wins.

200-500 beds: Subsequently, the decision depends on the timeline. Specifically, with 3+ month horizons, premium imports compete well. However, under 10 weeks, local sourcing wins.

Over 500 beds: Finally, import advantages increase due to scale. Nevertheless, this requires professional logistics management and quality verification.

Critical mistake I see: Primarily, comparing quoted per-bed prices without analyzing:

- First, installation costs (imports often underestimate assembly complexity)

- Second, warranty coverage reality (who pays shipping for replacements?)

- Third, failure and replacement rates (often 3-4x higher for budget imports)

- Finally, timeline risk costs (worker hotel accommodation is expensive)

Therefore, best practice: Request 3-year total cost of ownership projections, including all these factors. Ultimately, the cheapest quote is rarely the lowest total cost for labor camp furniture UAE projects.”

Frequently Asked Questions for Managers

Q1: Can local UAE bunk bed suppliers compete with Chinese factory pricing?

Initially, on per-bed initial cost: no, local manufacturers charge 40-65% more than Chinese budget imports. However, the total 3-year ownership cost, often yes, local suppliers win.

Specifically, independent testing shows budget imports averaging 15-22% replacement rates by month 18. Meanwhile, premium local manufacturing averages 3-5% replacement over 36 months. Therefore, total cost per bed per year often favors local suppliers for orders under 200 units.

Primarily, the local advantage is timeline (1-5 days vs 6-8 weeks). Additionally, for projects where accommodation delays cost AED 8,000-15,000 daily, speed has quantifiable financial value. Consequently, this often exceeds furniture cost differentials for staff accommodation furniture in Dubai projects.

Q2: What’s the actual quality difference between AED 400 beds and AED 650 beds?

Initially, testing revealed significant differences in materials and construction:

AED 400 Category (Budget Import):

- First, steel: 2.0-2.5mm wall thickness, 50mm tubing

- Second, coating: 35-45 micron paint layer

- Third, welds: spot welding at critical joints

- Fourth, platform: often plywood or MDF

- Finally, testing: basic structural only

- Expected UAE coastal lifespan: 12-18 months

AED 650 Category (Premium Local/Import):

- First, steel: 3.0-3.5mm wall thickness, 60mm tubing

- Second, coating: 75-90 micron epoxy powder coat

- Third, welds: continuous welding on stress points

- Fourth, platform: ventilated metal slats

- Finally, testing: salt spray, load testing, and durability protocols

- Expected UAE coastal lifespan: 60-84 months (5-7 years)

Notably, the difference emerges in year 2-3, not year 1. Initially, budget beds function adequately. However, they degrade rapidly in the UAE climate conditions. Therefore, when selecting labor camp furniture UAE, consider long-term performance.

Q3: Can I use triple-tier beds to maximize room capacity?

No. Explicitly, triple-tier (three-bunk) beds are prohibited under MOHRE Ministerial Resolution 44/2022.

What’s Actually Permitted:

- First, ✅ Single beds (standalone)

- Second, ✅ Double-tier bunk beds (two levels maximum)

- However, ❌ Triple-tier or three-bunk configurations (prohibited)

Additional Requirements for Double-Tier Beds:

- Initially, a minimum of 27 inches (68.6cm) clearance between sleeping surfaces

- Subsequently, a minimum of 48 inches (122cm) clearance around the bed for movement

- Additionally, the bed height minimum of 12 inches (30.5cm) from the floor

- Finally, an adequate ceiling height for a safe sitting position on the upper tier

Why This Matters: Using prohibited three-tier configurations results in:

- First, failed accommodation inspections

- Second, immediate compliance citations

- Third, the potential facility closure will remain until corrected

- Finally, legal liability for non-compliance

Recommendation: Therefore, design accommodation around double-tier bed capacity within regulatory spacing. Ultimately, attempting to exceed this through prohibited configurations creates serious risks for worker accommodation beds in Abu Dhabi facilities.

Q4: How do I verify supplier quality before ordering 300+ beds?

Verification Checklist for Local UAE Suppliers:

- First, ☐ Visit manufacturing facility (hesitancy is a red flag)

- Second, ☐ Inspect beds in current production

- Third, ☐ Examine weld quality and finish application

- Fourth, ☐ Request contact info for 2-3 recent projects

- Fifth, ☐ Review ASTM B117 salt spray test results

- Finally, ☐ Request a sample bed for a 30-day trial evaluation

For Import Suppliers:

- Initially, ☐ Verify supplier is manufacturer vs broker/agent

- Subsequently, ☐ Request factory certifications (ISO 9001 or equivalent)

- Then, ☐ Obtain salt spray test documentation with photos

- Additionally, ☐ Request load testing results

- Moreover, ☐ Demand pre-shipment inspection rights

- Furthermore, ☐ Verify exact coating specifications in writing

- Finally, ☐ Contact UAE clients who’ve used this supplier

Critical Questions:

- First, “Can I visit your facility?” (local) or “Can I hire an inspector?” (import)

- Second, “What’s your steel gauge specification with verification method?”

- Third, “What’s the actual powder coating thickness and test results?”

- Finally, “Who pays shipping if warranty beds need replacement?”

Major Red Flags:

- First, reluctance to provide verifiable references

- Second, can’t or won’t provide testing documentation

- Third, specifications change between the quotation and the final order

- Finally, pressure to order immediately “before price increases.

Q5: What warranty terms actually matter for camp furniture?

Critical warranty components:

Structural Coverage (most important):

- Initially, a minimum of 24 months on frame integrity, welds, and load-bearing components

- Subsequently, it should cover material defects and construction failures

- Finally, verify: Who pays shipping/labor for warranty claims?

Finish/Coating Coverage:

- First, a minimum of 12-18 months on rust and corrosion resistance

- Second, shecify climate conditions (coastal vs inland zones)

- Finally, verify: What level of rust triggers warranty (cosmetic vs structural)?

Exclusions to Understand:

- First, most warranties exclude “normal wear and tear” (definition varies)

- Second, improper installation often voids coverage

- Third, overcapacity use (exceeding weight limits) is typically excluded

- Finally, some suppliers exclude coastal zone installations entirely

Red Flags:

- First, “Manufacturing defects only” (excludes climate-related failures)

- Second, the warranty requires shipping beds back to the origin country

- Third, no written warranty terms, only verbal promises

- Finally, the coverage period is under 12 months

Best Practice: Therefore, request written warranty terms before ordering. Additionally, for import orders, clarify who handles replacement logistics and associated costs.

Q6: Can I mix imported beds with locally-sourced beds in the same camp?

Yes, and increasingly this is a common strategy among sophisticated procurement teams.

Typical approach:

- Initially, 60-70% baseline capacity: cost-effective imports (when timeline allows)

- Subsequently, 30-40% flexible capacity: local sourcing for rapid deployment

Benefits:

- First, cost optimization on the bulk baseline inventory

- Second, timeline protection for urgent needs

- Third, replacement/emergency capacity without import delays

- Finally, risk distribution across supply sources

Considerations:

- First, maintain consistent quality standards (don’t mix premium and budget)

- Second, standardize dimensions for mattress and linen compatibility

- Finally, document supplier performance for future procurement decisions

Q7: What’s the single biggest mistake camp managers make?

Primarily, optimizing for the lowest initial per-bed cost without calculating total project economics.

Real example: 280-bed camp comparison

Decision A (Lowest Per-Bed Cost):

- Initially, bed cost: AED 380 × 280 = AED 106,400

- Subsequently, timeline: 8 weeks (worker arrival in 6 weeks)

- Then, result: AED 38,000 emergency hotel costs

- Additionally, AED 42,000 in repairs/replacements over 24 months

- Therefore, true total cost: AED 186,400

Decision B (Higher Per-Bed but Timeline Secure):

- Initially, bed cost: AED 620 × 280 = AED 173,600

- Subsequently, timeline: 3 days (worker arrival in 6 weeks)

- Then, result: No delays, AED 4,200 maintenance over 24 months

- Therefore, true total cost: AED 177,800

Surprisingly, Decision B saved AED 8,600 despite costing AED 67,200 more for furniture.

Better approach: Calculate total project cost, including:

- First, timeline risk and delay costs

- Second, a 3-year maintenance and replacement projection

- Third, emergency housing costs if delays occur

- Finally, project penalties for accommodation delays

Ultimately, the “expensive” option frequently delivers a lower total cost when all factors are included.

Q8: Is climate-optimized furniture from local suppliers real or just marketing?

Both, specifically, it’s a legitimate technical differentiation that also happens to be effective marketing.

Verifiable climate optimization differences:

Testing data shows premium local suppliers typically specify:

- First, powder coating: 75-90 microns (vs 35-50 microns standard imports)

- Second, salt spray resistance: 1,200+ hours (vs 250-400 hours budget imports)

- Third, ventilated platforms: 85% of local premium vs 20% of budget imports

- Finally, reinforced joints: continuous welding vs spot welding

Notably, these aren’t minor variations. Specifically, they directly impact service life in 75-85% humidity with 45°C temperatures.

Is it essential? Depends on location and quality expectations:

- First, coastal camps (within 5km of sea): climate optimization delivers 3-4x longer service life

- Second, inland camps: advantage reduced but still meaningful (2-3x service life improvement)

- Finally, temporary camps (< 24-month use): climate optimization may exceed needs

Verification method: Request ASTM B117 test results. Specifically, suppliers actually performing climate testing will provide documentation within 48 hours. However, those unable to provide testing rely on marketing claims rather than engineering.

Honest answer: Premium local bunk bed suppliers in the UAE do engineer for local conditions because they see the failures firsthand. Nevertheless, whether that justifies a cost premium depends on your project timeline, location, and expected facility lifespan.

Making an Informed Decision

This guide provided independent analysis across supplier categories, pricing transparency, climate testing data, and real project outcomes. Specifically, this is information most bunk bed suppliers in the UAE won’t publish because an honest comparison doesn’t favor any single option universally.

The right choice depends on your specific situation:

Contact Karnak Home when:

- First, the timeline is under 8 weeks to the delivery requirement

- Second, a coastal location with harsh climate exposure

- Third, project size under 300 beds

- Fourth, facility inspection before ordering valued

- Finally, local support and warranty service priority

Consider premium import alternatives when:

- Initially, order size 500+ beds with a 3+ month planning horizon

- Subsequently, working with a verified supplier with a documented UAE track record

- Additionally, professional logistics management is available

- Finally, cost optimization is critical with quality verified

Evaluate budget options when:

- First, temporary installations (12-24 months of use)

- Secondly extremely limited budget with a replacement cycle understood

- Finally, inland, lower-humidity locations only

Contact Information

Karnak Home – Established 1988

📍 Office 110C, Diamond Business Center

Arjan, Al Barsha 3, Dubai, UAE

📞 +971 58 908 8107 / +971 6 579 9632

📧 sales@karnakhome.com

💬 WhatsApp Support: +971 58 824 5885

Showroom Hours:

Monday – Saturday: 10:00 AM – 8:00 PM GST

(Closed Sundays and UAE Public Holidays)

Current Lead Times (January 2026):

- First, Dubai/Sharjah: 1-3 days

- Second, Abu Dhabi: 2-4 days

- Finally, Northern Emirates: 3-5 days

Payment Options:

- Initially, full payment or 4 installments (Tabby/Tamara)

- Additionally, Apple Pay, Google Pay

- Furthermore, all major credit cards

- Finally, bank transfer for commercial orders

Facility Visits Welcome: Schedule an inspection of our Arjan manufacturing facility. Notably, unlike many suppliers, we’re confident enough in our processes to show exactly how we manufacture staff accommodation furniture Dubai solutions.